With everything that’s happening right now, I’ve been more than a little overwhelmed. I’ve been thinking of ways to cut down on stress and make time for the things that relax me.

With everything that’s happening right now, I’ve been more than a little overwhelmed. I’ve been thinking of ways to cut down on stress and make time for the things that relax me.

The line between work, home, and work-at-home has become too blurry. Chores around the house are being neglected, and I feel like I’m constantly “on the lock.” I’ve decided to set some boundaries for the next couple months to keep me focused and give me time to chill out.

No laptop in bed.

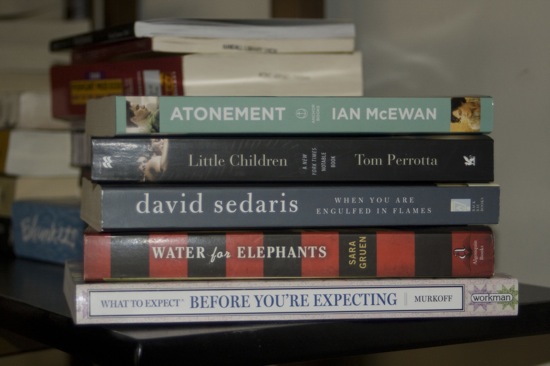

One of the things I miss most when life gets hectic is reading fiction. When I’m stressed, nothing is more relaxing than forgetting about my to-do and immersing myself in a book. Stress also leads to insomnia for me, especially when I’m working right up until I try to sleep. Reading before bed calms me and takes my mind off the stress in the moments before I sleep.

Solution: I’ve banned myself from bringing my laptop to bed with me. For the past week, I’ve been forcing myself to read instead of work or plan, and it’s definitely helping me sleep better and relax a little in the evening. It also gives me an opportunity to spend time with my husband without our laptops between us.

Set time limits.

Since I work full time throughout the week, I do the bulk of my personal planning and projects on the weekends. Since the weekends are my only chance to relax, working too much on Saturday and Sunday cuts back on my “me” time. I feel like I spend all morning working and the afternoons are eaten up by errands and household chores.

Solution: Weekend days are now “work days” with the same limits. I work 8:30 to 5:30 on the weekdays, so why should I be on the clock non-stop on Saturday and Sunday? I’ll spend weekend mornings planning, writing and working until 2 p.m. From 2 to 5:30 p.m., I’ll get household chores done, but the weekend evenings are mine to relax, exercise, and spend time with Tony.

I’m making myself and my family a priority.

I think we all have a tendency to put what we can on the back burner when time is limited. That means that the things and people we love most often get the shaft. I’m definitely guilty of this. If I’m busy, my work out is the first thing I cut. After that, I’m likely to sacrifice time with my husband if I’ve got a lot going on. But why should the things that are most important to me take a backseat?

Solution: The things that are most important to me are non-negotiable. I’m limiting “overtime” when it comes to personal projects. During the times that I’ve allotted to myself and my family, taking me time and being with my husband are the only things on my to-do list.

Have you set boundaries for your sanity? What would your rules be?